[Disclaimer: These are my own views, not financial advice. Use at your own risk.]

I’ve long embraced a whole-market, long-term investing mindset, but is focusing solely on U.S. stocks smart? Most wealth management advice points to one thing: asset allocation — a simple way to diversify beyond domestic stocks.

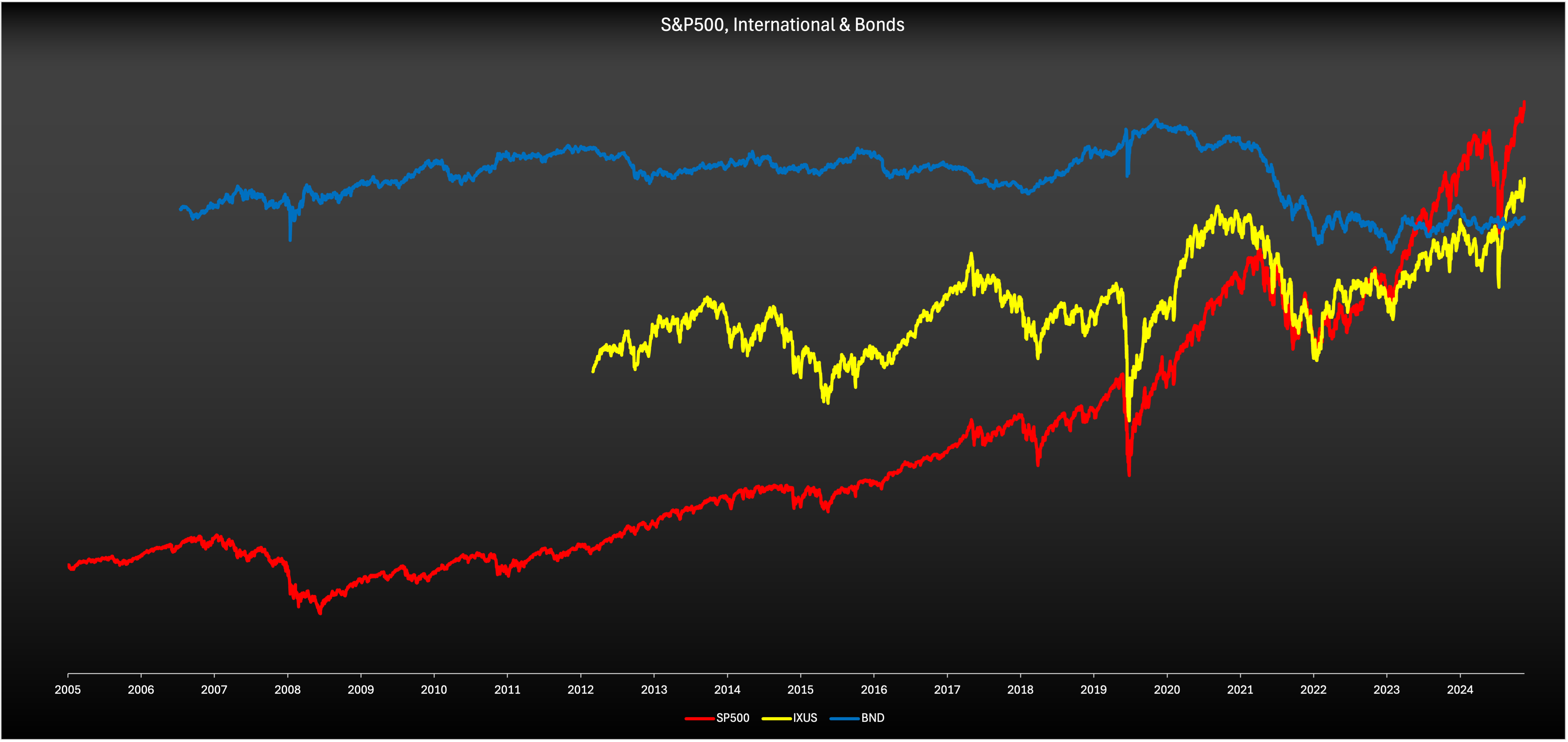

Diversification means spreading your investments across assets that behave differently, dampening volatility. The classic mix includes domestic stocks, international stocks, bonds, and cash. While not perfectly uncorrelated, bonds often stabilize portfolios, and international stocks add volatility along with diversification benefits. They look like this:

So, what’s the “right” mix? That depends on your risk tolerance, goals, and time horizon. Stocks carry more risk but higher potential returns; bonds reduce risk but lower returns. International stocks tend to be riskier but diversify you beyond U.S. market trends. As retirement nears, shifting toward safer assets can protect your funds from market dips.

There are plenty of resources to help find a mix that works for you, so I’ll just assume a balanced mix (say 35% domestic stock, 15% foreign stock, 40% bonds and 10% short-term – don’t forget your emergency fund) as an example.

The math?

- VTI (U.S. Total Stock Market): annualized returns around 10.15% over 15 years

- VXUS (International Stocks): annualized returns around 7.47% over 15 years

- BND (Total Bond Market): annualized returns roughly 2-3% range over 15 years

- Cash (3-month Treasuries): very low returns near 1-2% annualized

With 100% of $10,000 invested in US Domestic stock alone (say VTI), you would be looking at about $43,000 after 15 years. The balanced portfolio (35/15/40/10 mix) would have a blended return of about 5.8%, giving you about $23,500 after 15 years. Lastly, an aggressive (70/30/0/0) mix? This would give you a blended return of about 9.4%, leaving you with roughly $38,500 after 15 years.

The idea then is that early on in your investment years when you don’t need quick access to your funds, and can wait out any downturns, a higher risk mix might be a better option. This enables you to capture the market growth over the very long-term. But as your investment horizon shrinks, you might gradually move more into a safer mix so that downturns don’t ruin your retirement plans when you need quicker access to your funds.

Many mutual funds automate this “glide path,” but you can DIY with ETFs (I’ll cover why you might want to do that in another post). One practical approach is to track your favorite target-date funds’ allocations annually and mirror their shifts yourself.

Good luck!

-Gary

Some helpful resources:

- Fidelity: Asset allocation: What it is and how to develop one: https://www.fidelity.com/learning-center/trading-investing/asset-allocation

- Fidelity: Fidelity Freedom® Funds: https://www.fidelity.com/mutual-funds/fidelity-fund-portfolios/freedom-funds

- Fidelity: Retirement Investing Tips by Age: https://www.fidelity.com/myfidelity/InsideFidelity/NewsCenter/mediadocs/tips_by_age.pdf

- Vanguard: Rebalancing your portfolio: https://investor.vanguard.com/investor-resources-education/portfolio-management/rebalancing-your-portfolio

Leave a comment