Disclaimer: these are my own thoughts, not official financial advice. If you choose to copy my processes or suggestions, you do so at your own risk. I’m not responsible for your gains or losses 🙂

Once you’ve built up some savings — call it the “uninvested cash” bucket — the next big question is, “How do I get the best return?”

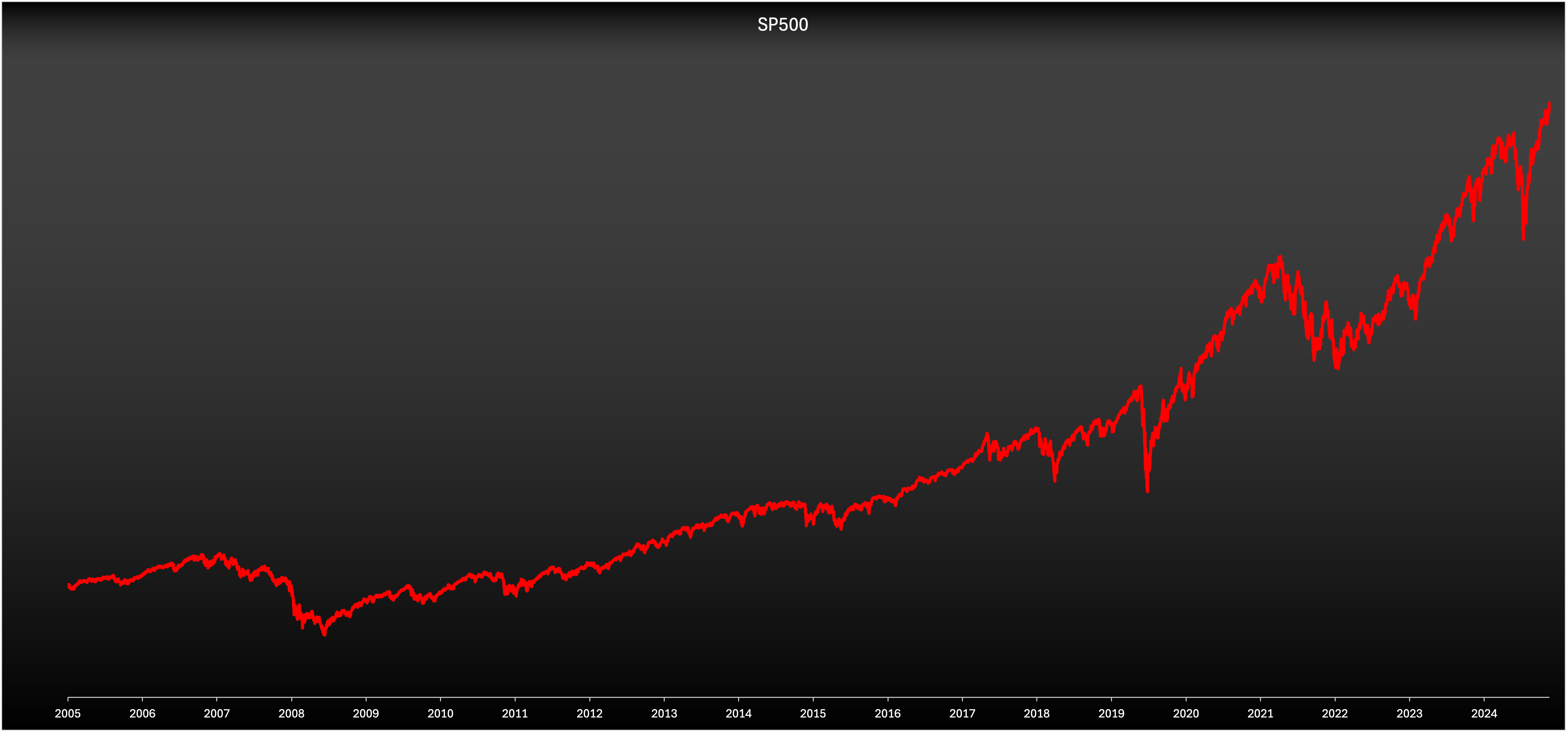

After reading countless investing books (my favorite: A Random Walk Down Wall Street) and chasing the “next hot stock,” I realized this was the wrong target. The goal isn’t the highest possible return — it’s the right return, balancing risk and reward. It’s not “How do I get rich quick?” but “How do I get rich reliably?” The research is clear: while magic stocks are rare, the overall market tends to rise over time.

So, instead of hunting for the next big winner, I put my money in the market as a whole. No more stress over picking the “right” stock — I just bet the market keeps going up (or is higher when I need my money back).

There is a huge caveat here I need to acknowledge – just because the markets did something in the past, doesn’t mean they’ll continue to do that in the future… but I don’t have a crystal ball handy.

Mutual funds can do this “whole market investing” for you, but they charge fees. My best fit became ETFs: low-fee, broad-market tools you can set and forget.

Some ETF examples: SCHB, VTI, ITOT, SPTM, BKLC. Honestly, the differences between them are minor in my opinion. I optimized for ease and low cost. You can mix growth and value, blend caps, get granular — but for my autopilot method, that was overkill. I picked my favorite whole market ETF and kept it simple.

Just betting on the US stock market isn’t the full story, though. Next time, I’ll share how I rounded things out for an even more resilient strategy.

Good luck!

-Gary

Leave a comment